Most people think rich people should pay more tax than poor people. There are at least three reasons for this. First, governments have to get their money from somewhere, and if everyone paid what poor people are able to pay, there might not be enough to run the government. Second, a given tax bill will do more damage to a poor person’s standard of living than to a rich person’s, so you can minimize the damage by having poor people pay less. Third, some people think it’s fair for rich people to pay more.

There are several ways of having rich people pay more tax. We tend to do this by taxing people more if they have higher incomes, although income and wealth aren’t the same thing. Taxing income instead of wealth doesn't really make sense to me, but maybe it's because it’s easier for rich people to avoid wealth taxes. But there are also different ways of taxing higher incomes more.

You can have a flat tax, so people pay in proportion to their income. 20% of a million pounds is more than 20% of ten thousand pounds. But that’s not what countries normally do. Normally they have what’s called a progressive tax. A progressive income tax is one where people with higher incomes pay a higher proportion of their incomes. The income tax in the UK is a progressive tax. Here are the rates:

You don’t pay any tax on the first £11,000 of yearly income, and then you pay 20% of the next £32,000, 40% of the next £107,000, and 45% of anything after that. People with higher incomes are paying higher rates. People making under £11,000 aren’t paying any income tax at all.

A progressive income tax has the “rich people pay more” effect to a greater extent than a flat tax does, and so leftwing people tend to like progressive taxes. Leftwing people these days also often call themselves “progressives”. As far as I know, this is a coincidence.

Now, as well as a flat tax or a progressive tax, there’s also the theoretical option of a regressive tax. You could just reverse the numbers in the table above: people pay 45% of the first £11,000, 40% of the next £32,000, 20% of the next £107,000, and nothing on income after that. Rich people are still paying more, just to a lesser extent. (Well, very rich people are all paying the same if the top rate is 0%. But very poor people are all paying the same, i.e. nothing, under the existing set-up. It still counts as rich people paying more than poor people.)

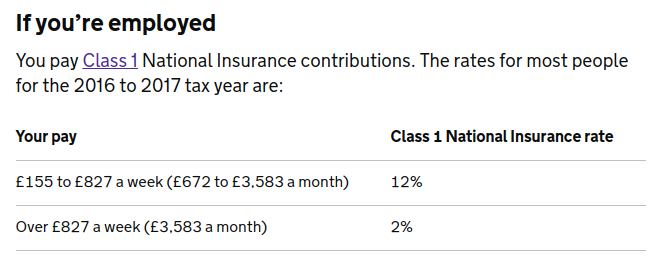

A regressive tax would probably be pretty unpopular. People would think it wasn’t fair, and to raise enough money to run the government you’d have to collect a lot of money from poor people, with inevitable damage to their quality of life. So it might surprise you to hear that the UK - the very same country that has the rather progressive income tax we talked about earlier - also has a very regressive tax. It’s called National Insurance. It doesn’t have the word “tax” in its name, but it’s still a tax. Here are the rates for employed people:

Eagle-eyed readers will have noticed that £155 a week is a lot less than £11,000 a year, so while the poorest workers aren’t paying any income tax, they’re still paying plenty of national insurance. £827 a week does also put you more or less on the cusp of the basic and higher rates of income tax, which I suppose counts for something. But the fact remains that the UK has a progressive income tax which politicians and journalists talk about a lot, but makes up for it with a regressive tax that they hardly talk about at all. I don’t know if other countries do this, but it certainly seems odd. It’s hard to see what ideology a government could have which would motivate levying both taxes.

Before the 2015 general election, David Cameron said he had raised the personal income tax allowance a lot. “That is three million people taken out of income tax altogether”, he said. And I suppose that technically it was, but they were still paying plenty of tax on their income and their marginal rate was still 12%. So what Cameron said was a little bit misleading.

I think it’s very likely that the reason we have a progressive income tax and a regressive employment-income tax to make up for it is because the government and the electorate don’t agree on how progressively they want income to be taxed, and so the government divides the tax into two and mostly talks about the one that sounds less nakedly plutocratic. Maybe that’s not why they do it, but I’d at least like an explanation.